Diverging Fortunes: A Comparative Analysis of Housing Markets in Australia and New Zealand

Brissy Buzz

Archives

Diverging Fortunes: A Comparative Analysis of Housing Markets in Australia and New Zealand

SIGN UP FOR OUR NEWSLETTER

Diverging Fortunes: A Comparative Analysis of Housing Markets in Australia and New Zealand |

Australia's property market thrives while New Zealand faces challenges |

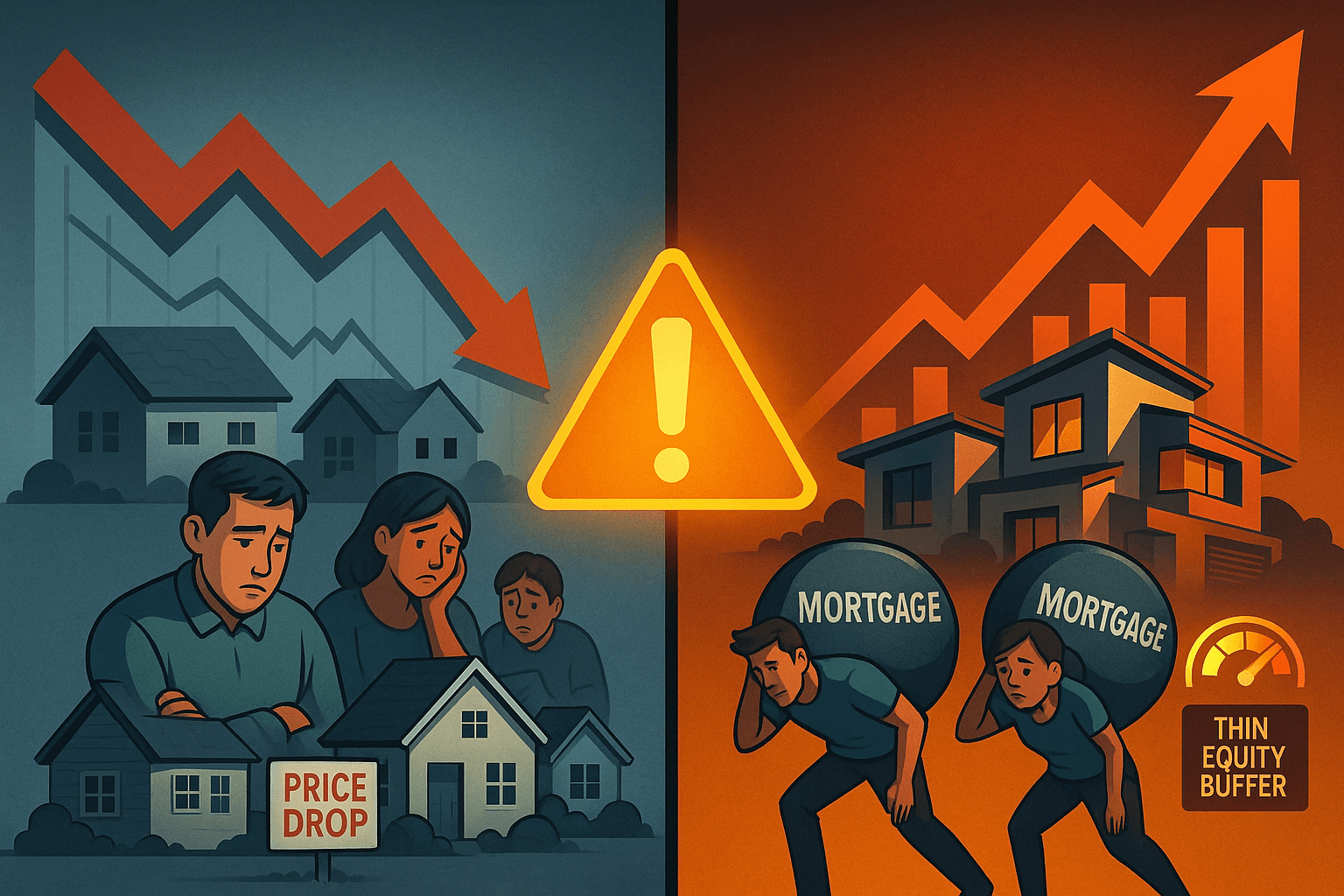

Australia's housing market has reached unprecedented heights, with the national median property price surpassing A$1 million for the first time in March 2025. This milestone reflects a robust demand fueled by population growth and limited housing supply. Major cities like Sydney and Melbourne have seen significant price increases, contributing to the overall market surge.

In contrast, New Zealand's housing market has experienced a downturn. According to the Real Estate Institute of New Zealand (REINZ), the national median house price in February 2025 was NZ$750,000, approximately 11% below the peak recorded in late 2021. Auckland, the country's largest city, saw its median house price drop to NZ$1.02 million in March 2025, down from over NZ$1.2 million during the boom.

The Reserve Bank of New Zealand's (RBNZ) aggressive interest rate hikes, with the Official Cash Rate reaching 5.5%, have significantly dampened buyer demand. High mortgage rates have reduced borrowing capacity, leading many potential buyers to delay entering the market. This cautious sentiment is reflected in a 14% year-on-year drop in residential sales as of March 2025.

In Australia, the Commonwealth Bank has expressed concerns over the sustainability of the current housing demand. CEO Matt Comyn highlighted that while the bank has benefited from the surge in housing credit, such high levels are unsustainable and could undermine long-term financial stability. The Australian Bureau of Statistics reported a 6.4% increase in new housing loan commitments in Q3 2025 compared to Q2, driven by low interest rates and strong demand.

New Zealand's government has introduced the Fast-track Approvals Act 2024 to expedite infrastructure and housing projects, aiming to address the housing shortage. However, the effectiveness of this legislation in reversing the current market downturn remains to be seen.

The contrasting trajectories of the Australian and New Zealand housing markets underscore the complex interplay of economic policies, interest rates, and market sentiment. While Australia's market continues to thrive, New Zealand's experience serves as a cautionary tale, highlighting the potential risks of rapid interest rate hikes and the importance of balanced economic policies. |